If you are looking to set up your own business you might be wondering what business structures are available and which one you should choose. When it comes to deciding which structure to adopt you may wish to consult with an Accountants Gloucester way as there are benefits and drawbacks to each of them. Accountants Gloucester Randall and Payne can then help you with any set up and any financial reporting and accountancy support that you may need.

Here are the main business structures that you have to choose from.

Sole Trader – this is the easiest form of business to register as you are self employed and work for yourself. You need to let HMRC know that you are now self employed and you will be responsible for completing annual tax returns.

Partnership – this is where two or more people agree to share the profits and any losses that are made by the company. They are in essence responsible for each other’s misconduct and so this is not a structure to enter into lightly.

Limited Liability Partnership – similar to a partnership but your amount of liability is limited to the amount you invested into the business.

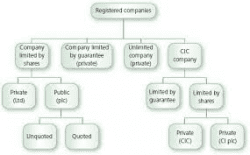

Limited Company – a privately managed business that is run by the directors. The company has its own legal obligations and rights and profits are retained by the company after any corporation tax is paid. The directors are then responsible for paying their own self employed tax.