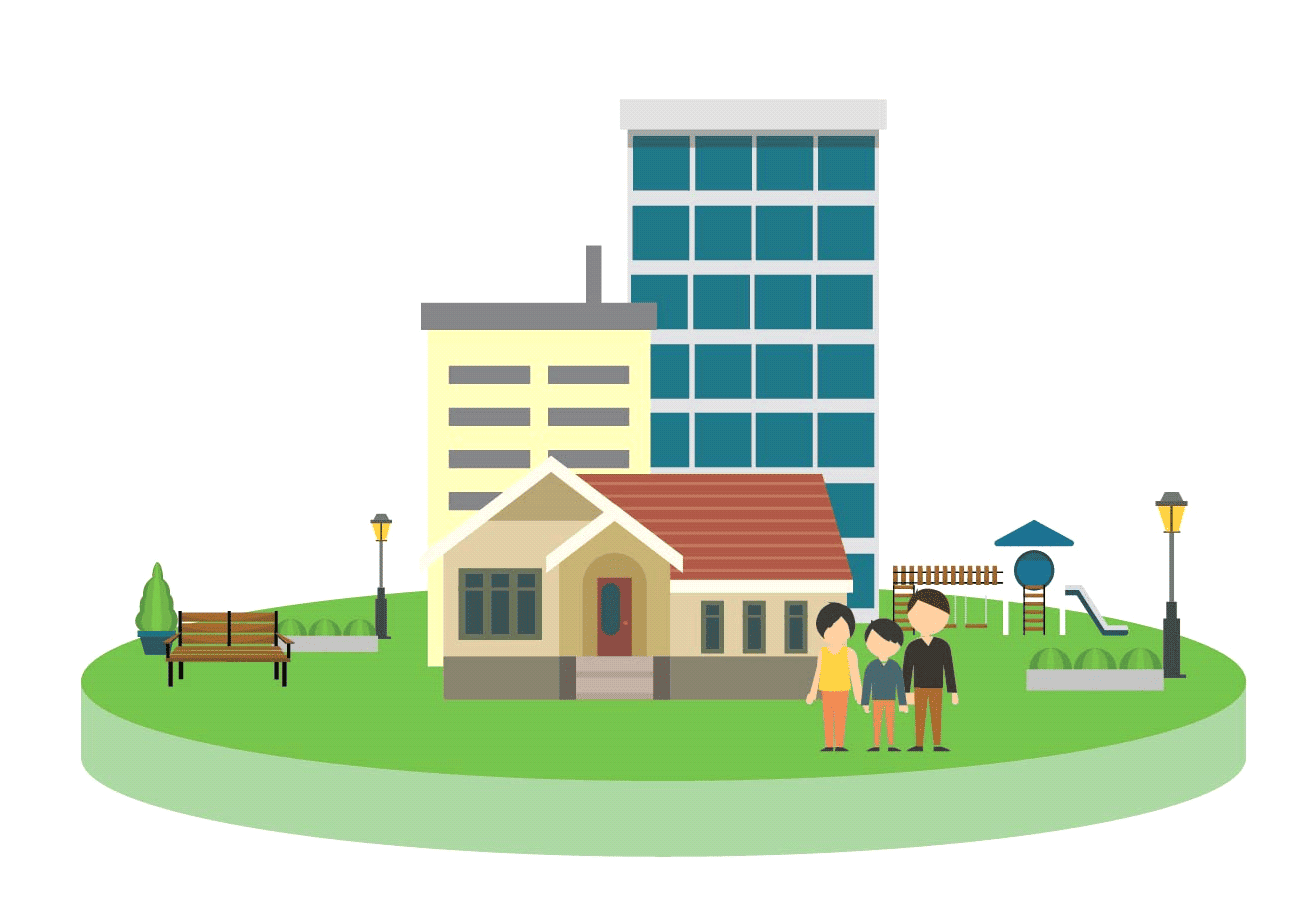

A real estate tax (or land tax) is a fee that is assessed on each lot or parcel of land for the cost of improvement or construction. A property assessment is a fee assessed on all types of property, including the home. Property assessment is usually the first assessment made to assess the value of a home. A land tax also includes taxes on other properties owned by the owner of a home. These include businesses, public schools, and churches. Find out more about a SDLT Refund at a site like Sentient SDLT, providers of SDLT Refund assistance.

A land valuation tax is an assessment made on the total unimproved worth of land. Land values vary widely, depending on location, climate, topography, and the condition of the land’s soil. Generally, the more land there is to be taxed, the higher its assessment rate. An appraisal of land is a process where a land appraiser estimates the fair market value for each lot or parcel of land for use in the assessment. This estimation is based on the information collected from previous appraisals and surveys. A land appraiser normally computes a range based on the average price paid in appraised sales and the conditions of the soil and topography.

In addition to this, there are other factors that are considered when determining the tax rate. Some include the age of the home, type of structure, size and shape of the lot, size and shape of the dwelling, the location of dwellings, and types of improvements. The appraisal is generally made before the property is even constructed, to determine the amount needed for capital improvements. The assessment is then made at the time of application for a mortgage. or after the property has been purchased.